maine excise tax refund

Political Subdivision Refund Request Form. Narratives IFTAIRP Refund Programs.

New Analysis A Third Of Nc Taxpayers Won T Benefit From Proposed Tax Refund Plan Itep

16 rows Effective July 1 2009 the full diesel excise tax rate is imposed on biodiesel fuels that.

. Any change to your refund information will show the following day. Th For example a 3 year old car with an MSRP of 19500 would pay 26325. HOW IS THE EXCISE TAX CALCULATED.

Tax Return Forms NOTE. 1 If a motor vehicle is sold or lost the motor vehicle owner may be entitled to a credit for the excise tax paid on the sold or lost vehicle against the excise tax due on a subsequent vehicle. Requests for a refund must be filed within 12 months of the date of purchase of the fuel.

A refund of excise tax may be available on purchases of gasoline or diesel purchased and used by a government agency or political subdivision of this state 36 mrs. Like all states Maine sets its own excise tax. You can also deduct the excise tax portion of your Maine vehicle registration as it based on the value of the.

Refund requests that cannot be supported by proper invoices and off-highway usage documentation will be denied. In Maine you may deduct the sales taxes paid on the purchase of a new vehicle. Please enter the primary Social Security number of the return.

Watercraft Excise Tax Payment Form - 2022. Below are the links to these forms if you wish to complete and paper file them. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

Fuel exempt from maine excise tax becomes subject to maine salesuse tax. 3 Damaged or improperly stamped. Political Subdivision Instructions PDF Affidavit for Assignment of Refund PDF Note.

Online calculators are available but those wanting to figure their excise tax in Maine can do so easily using a manual calculator or paper and pen. Federal Fuel Excise Taxes. 2721 - 2726.

Welcome to Maine Revenue Services EZ Pay. Choose your filing status and then enter the refund amount you are claiming. The purpose of the tax is to partially offset the costs of forest fire protection expenditures of the Department of Agriculture Forestry and Conservation.

The amount of the refund must be the percentage of the excise tax. I paid excise tax on 2 vehicles. Maine residents that own a vehicle must pay an excise tax for every year of ownership.

Enter refund amount as whole dollars only dont round just drop the cents. The town that collects the excise tax can use it as revenue towards the. Refunds will be reduced by SalesUse tax due.

A refund cannot be issued for purchases made more than 18 months from the date the refund request is filed. While sales tax refunds are available for goods that are purchased in Maine and exported Maine excise taxes paid on goods are generally non-refundable. TaxAct does not support Form 8849 Claim for Refund of Excise TaxesThis is a separate return from the individual tax return on Federal Form 1040 US.

Marijuana Excise Tax Return. SummaryCurrent law provides for a motor vehicle excise tax credit for the owner of a vehicle that is totally lost by fire theft or accident or is totally junked or abandoned. If line 9 less line 10 is a credit amount enter the amount to the right.

Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the excise tax provides evidence that the registration has been voluntarily surrendered and cancelled under Title 29-A section 410. Individual Income Tax Return.

Period Begin Period End Due Date. Excise tax is calculated by multiplying the msrp by the mil rate as shown below. Creditrefunds of excise tax.

If you wish a refund rather than a carry forward to the next period check here. Environmental Fees Ground Water Tax - offsite. Watercraft Excise Rate Chart.

Commercial Forestry Excise Tax. 2021 - Maine Town City and County Management Association. This bill clarifies that the motor vehicle excise tax credit is available only if the vehicles ownership is transferred the vehicle is totally lost by fire theft or accident the vehicle is totally junked or abandoned.

Incentives may exist allowing certain state of federal excise taxes to be refunded on goods bought for specific uses but such incentives change frequently. A transfer fee of 3 is due to the municipality. Requests must be made within 90 days of return of the cigarettes to the manufacturer.

Or rather you would include it along with your other sales taxes paid in lieu of the alternative choice of taking a deduction for state sales taxes paid. 19500 X 0135 26325 WHERE DOES THE TAX GO. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehiclePlease note this is only for estimation purposes the exact cost will be determined by the city when you register your vehicle.

Credits and refunds of excise tax are allowed as follows. Requests filed after the 12 month period will be denied. The bureau shall refund all excise tax paid by the wholesale licensee or certificate of approval holder on all malt liquor or wine caused to be destroyed by a supplier as long as the quantity and size are verified by the bureau and the destruction is witnessed by an authorized representative of.

This program does not apply to fuel that has been purchased exempt from the Maine excise tax. The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land. OWNERSHIP OR NAME CHANGE.

Refund information is updated Tuesday and Friday nights. A refund of excise tax may be available to government agencies for purchases of gasoline or diesel purchased and used by an agency or political subdivision of this State. Fuel exempt from Maine excise tax becomes subject to Maine salesuse tax.

According to the instructions on the Maine website you can take a deduction on your Maine tax return for most of the itemized deductions that you take on the federal return and this would include the personal property tax that you paid for your vehicles. Maine Cigarette Tax - 200 pack. Tax payments for these tax types can be made now via the Maine Tax Portal MTP at.

The rates drop back on January 1st each year. Request for a refund must be made on a Cigarette Tax Refund Application and be accompanied by a statement from the manufacturer that the packs have been returned with the Maine excise stamps affixed to the pack. Maine taxpayers now have the option to pay various tax payments online quickly and easily.

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

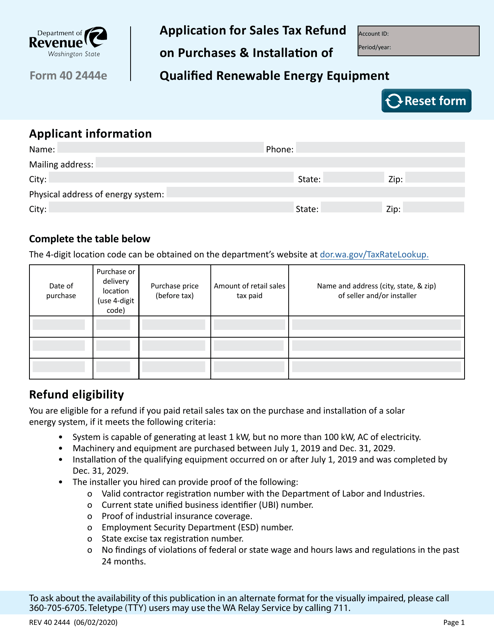

Form Rev40 2444 Download Fillable Pdf Or Fill Online Application For Sales Tax Refund On Purchases Installation Of Qualified Renewable Energy Equipment Washington Templateroller

Business Tax Refund Flyer Affiliate Professional Clean Amp Flyer Ad Tax Refund Business Tax Flyer

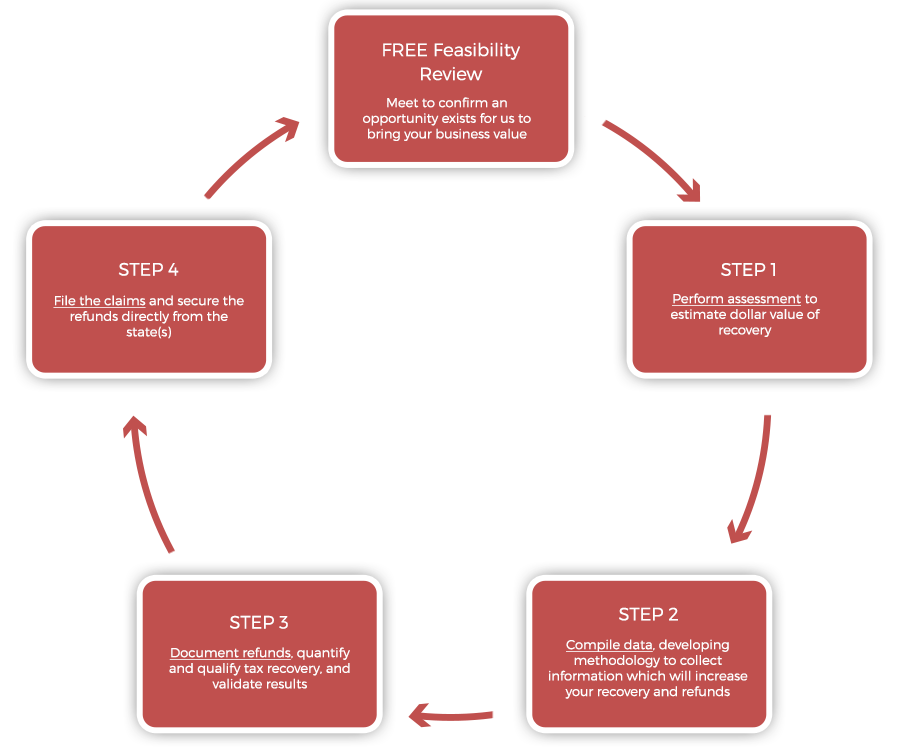

Fuel Tax Recovery And Refund Services National Fleet Services Llc

Rising Gas Prices Excise Tax Refund Offers Relief Tip Excise Tax Recovery Services

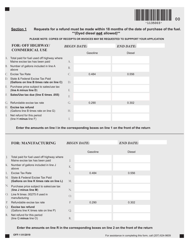

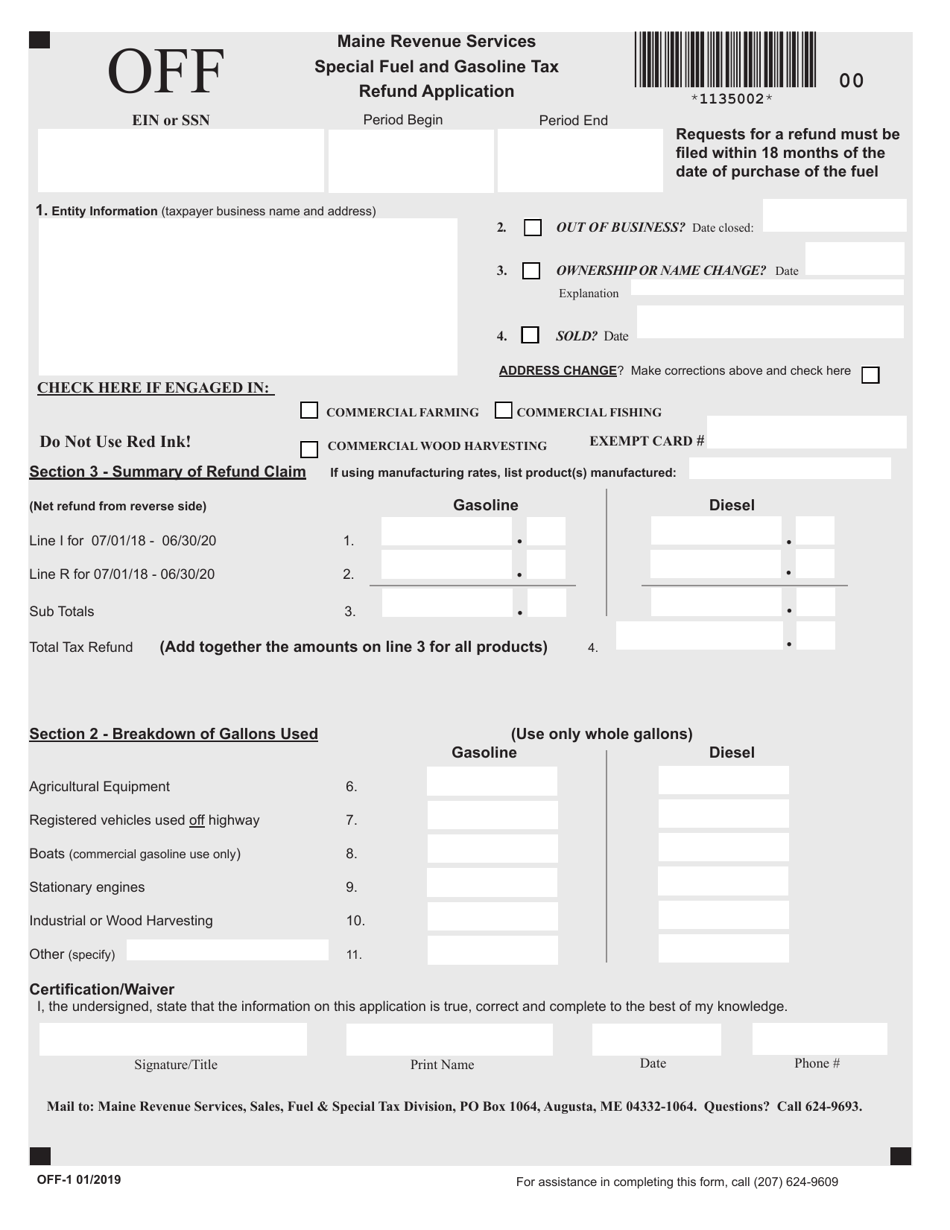

Form Off 1 Download Fillable Pdf Or Fill Online Special Fuel And Gasoline Tax Refund Application Maine Templateroller

3 11 3 Individual Income Tax Returns Internal Revenue Service

Spanning Nearly Two Hundred Pages Comprising The Cgst Sgst Act Gst Valuation Determination Useful Of Pr Goods And Service Tax Goods And Services Tax Refund

Form Off 1 Download Fillable Pdf Or Fill Online Special Fuel And Gasoline Tax Refund Application Maine Templateroller

Irs Sending 1099 Ints To Taxpayers Who Got Interest Added To Tax Refunds Don T Mess With Taxes

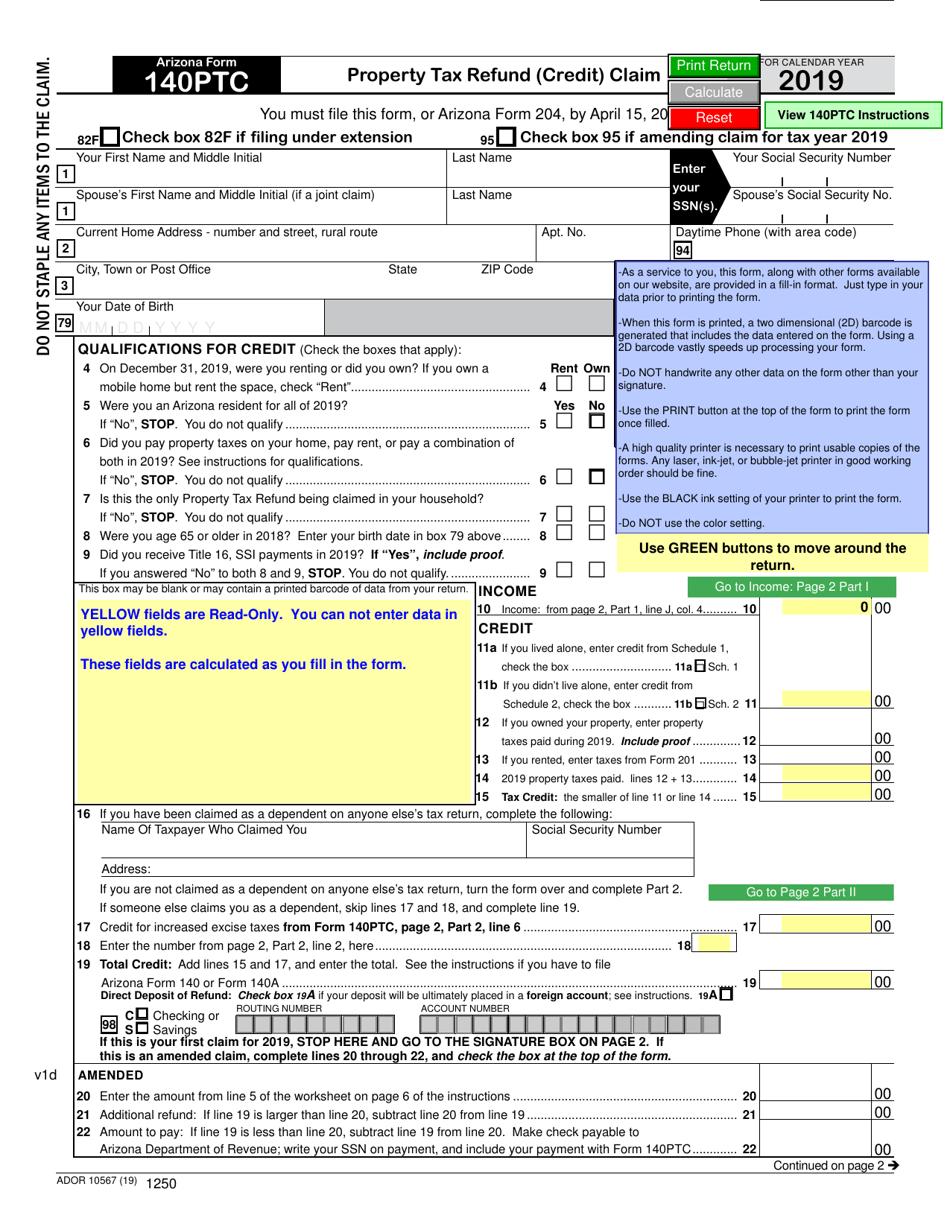

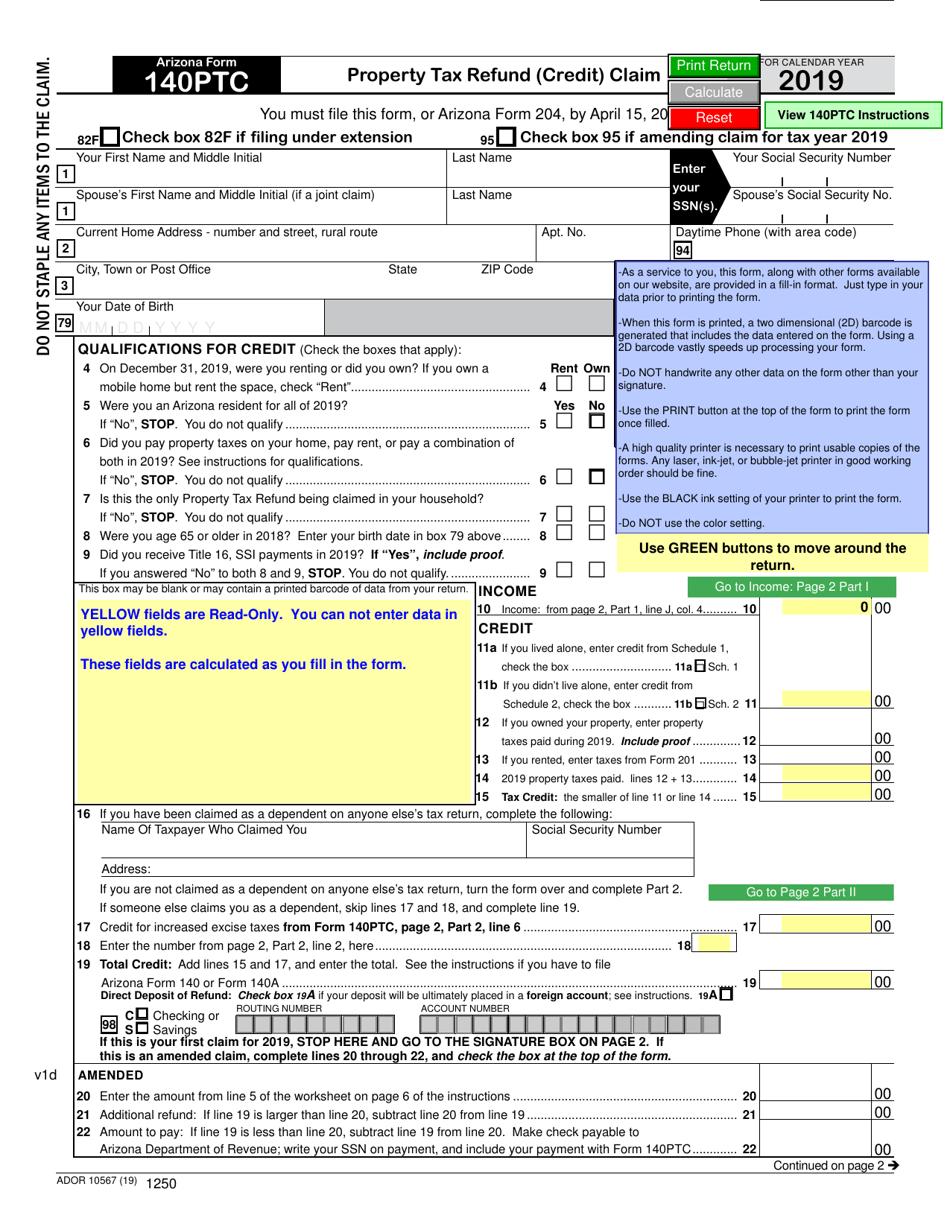

Arizona Form 140ptc Ador10567 Download Fillable Pdf Or Fill Online Property Tax Refund Credit Claim 2019 Arizona Templateroller

How Do I Estimate My Tax Refund Laws Com

How Long Does It Take To Get Tax Refund From The Federal Government Current School News

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

N 86 53 New Car Lemon Law Sales Tax Refund Nysdra

2019 Tax Returns Are Down What States Could Be Impacted Most