alabama delinquent property tax phone number

To redeem the delinquent owner must tender the amount the purchaser paid to buy the Talladega County Alabama tax lien certificate plus any additional property tax the purchaser has paid up to the expiration of the 3 three year redemption period plus 12 per annum Sec. Property Tax Alabama Department Of Revenue.

Alabama Property Tax H R Block

If assessed and levied against the property these taxes can be recovered at public auction.

. Registration for Business Accounts. Checks or money orders should be made payable to the Alabama Department of Revenue. Ph 2512753376 Fx 2512753498 Example.

Please call the assessors office in Wetumpka before you send documents or if you need to schedule a meeting. Do I have to pay taxes if they are less than 1 one dollar. Section 40-10-180 of the Code of Alabama declares the tax collecting official for each county shall have the sole authority to decide whether his or her county shall utilize the sale of a tax lien for the sale of.

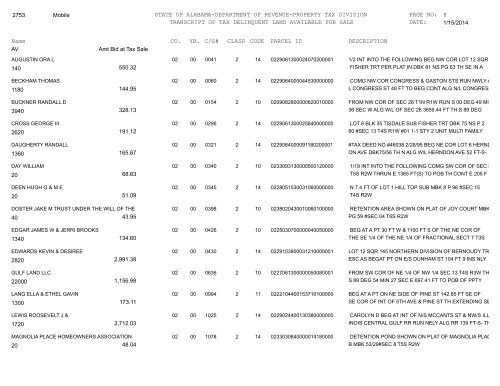

Below is a listing by county of tax delinquent properties currently in State inventory. It is authorized for the Revenue Commissioner to secure payment of delinquent taxes through an auction of tax liens for sale and transfer of perpetual first priority liens provided by Alabama Code 40-1-3. Additional information on property tax exemptions are listed below.

A t tachments 4 Page History. Any properties not purchased at the Tax Sale by individuals or companies are sold to the State of Alabama. 220 2nd avenue east room 105 oneonta al 35121.

Alabama Department of Labor 649 Monroe Street Room 4207 Montgomery AL 36131. Alabama delinquent property tax phone number. If you have documents to send you can fax them to the Elmore County assessors office at 334-567-1116.

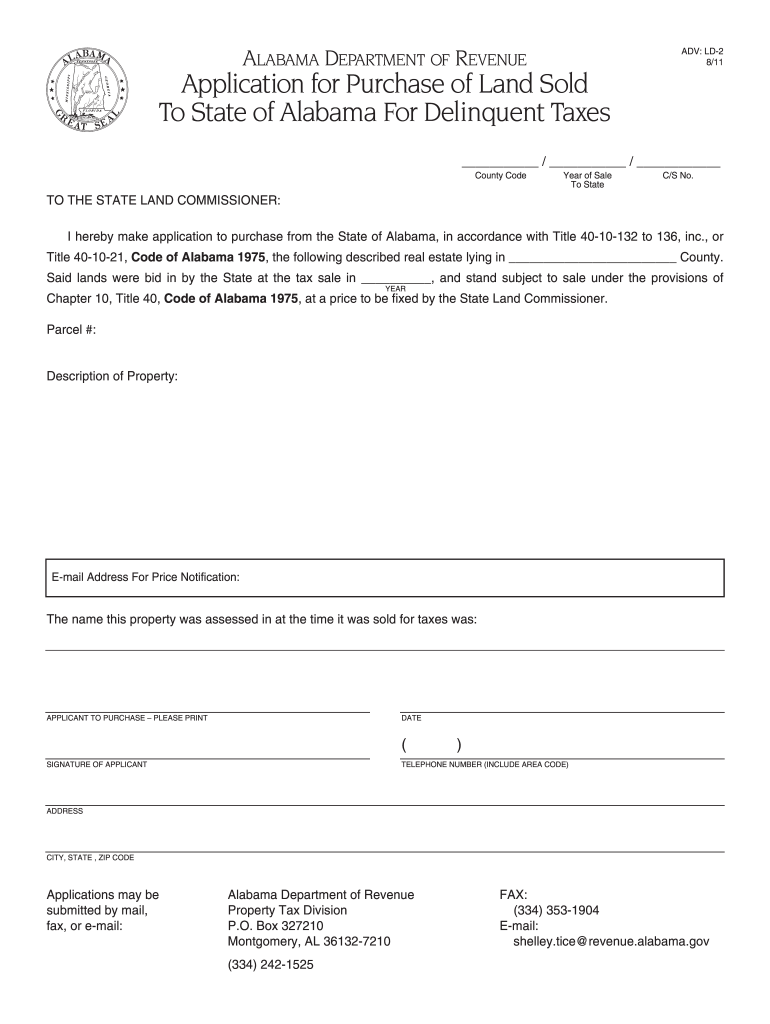

And work with the sheriffs office to foreclose on properties with delinquent taxes. When is the last day I can file my Quarterly Contribution and Wage Report and not be late. Once you have found a property for which you want to apply select the cs number link to generate an online application.

Assessor Revenue Commissioner and Tax Sales Mobile County Revenue Commissioner 3925 Michael Blvd Mobile AL 36609 Phone. You may contact the Revenue Commissioners Office to make sure your taxes are current. Always write your assessment number and account number on the check.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Monday Friday 800 am-500 pm. Wilcox County Assessor Phone Number 334 682-4625.

Tax Delinquent Properties for Sale Search. If you are wishing to buy tax delinquent property you must contact the Alabama Department of Revenue and they will only accept certified checks for these properties. Resolved comments 0 View in Hierarchy.

When using a social security number mask the number using the following format. You may search for Tax Delinquent property for sale here. 114 Court Street Grove Hill ALABAMA 36451.

The median property tax in Wilcox County Alabama is 24600. This is official notice that Tax Collector Jones has chosen. The transcripts are updated weekly.

Alabama Department of Revenue - ADOR - Confluence. View How to Read County Transcript Instructions. Sales.

Perry County Assessor Phone Number 334 683-2219 Perry County Assessors Website. You should contact this office for information regarding additional exemption entitlements. The median property tax in Perry County Alabama is NA.

Sales Use Tax. When contacting Wilcox County about your property taxes make sure that you are contacting the correct office. List of all counties in Alabama - click a county below to view current tax delinquent properties on a searchable map including upcoming sale properites tax deeds tax certificates and tax liens.

Property taxes are due October 1 and are delinquent after December 31 of each year. Search Mobile County property tax records by owner name address or parcel number and pay taxes online. Transcripts of Delinquent Property.

Search Tax Delinquent Properties. 40-10-122 on the minimum and the overbid see notes on bidding. Does Alabama Sell Tax Liens.

NOTICE OF DECLARATION OF THE JEFFERSON COUNTY TAX COLLECTORS OFFICE TO TRANSITION TO TAX LIEN AUCTION. All taxable real and personal property with the exception of public utility property is assessed on the local level at the county courthouse with the county assessing official. To contact our office directly please call 205 325-5500 for the Birmingham Office or 205 481-4131 for the Bessemer Division.

You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State. 334-242-1490 General Info or 1-866-576-6531 Paperless Filing Info Taxpayer Advocacy. PUBLIC NOTICE TAX LIEN PUBLICATION.

To report a criminal tax violation please call 251 344-4737. Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land. If you have any questions contact a Revenue Compliance Officer by calling 334 353-8096.

All taxes due are payable. Susan Jones Tuscaloosa County Tax Collector Tuscaloosa Alabama has been vested with the sole authority under Alabama Code 40-10-180 1975 to select whether Tuscaloosa County Alabama shall utilize the sale of tax lien or the sale of property to collect delinquent property taxes. And work with the sheriffs office to foreclose on properties with delinquent taxes.

Once you have found a property for which you want to apply select the CS Number link to generate an online. Our vision is to assure the citizens of Alabama that compliance with the property tax laws rules and regulations is maintained in an efficient and effective manner.

Marengo County Alabama 2017 Delinquent Property

Property Tax Alabama Department Of Revenue

02state Of Alabama Department Of Revenue Property Tax Division

Property Tax Alabama Department Of Revenue

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

How To Find Tax Delinquent Properties In Alabama Ozark

Tax Notice Error Causes Homeowners To Fear Eviction Wbma

Tax Delinquent Land Sales In Alabama Wholesale Home Buyers Land For Sale Real Estate Buyers We Buy Houses

J L Investment Of Alabama Home Facebook

Al Adv Ld 2 2011 2022 Fill Out Tax Template Online Us Legal Forms

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site